OK, so we all have our own personal boundaries and ideas on essential versus non-essential spending. That said, the economic adversity of the past few months has shown that there are just some brands we will always spend on, either through necessity or determination.

This puts certain sectors in the spotlight as ‘the untouchables’ — the ones that will retain their engagement and pre-crisis sales because their audiences deem them essential or, at the very least, important and worthy of prioritisation.

UK consumer behaviour during a recession or downturn: the insights

At the time of writing, a cost of living crisis means that almost everyone is feeling the pinch to some extent. In the wake of this economic uncertainty, research reveals how people are adapting their behaviour.

According to YouGov’s latest Financial Outlook, 64% of British households report that their disposable income has reduced. This is the most of any country globally. 29% say it’s stayed the same, whilst a lucky 15% report it growing.

As Brits, we’re also the most pessimistic about the future. Typical us, eh? 61% of us think our disposable incomes will continue to decline. That’s greater than all other countries, including Italy (55%), France (53%), Germany (45%) and the US (37%).

“83% of UK consumers either feel ‘fairly or very cautious’ about how they’re spending their money.”

According to Klaviyo’s consumer behaviour survey, we’re all acutely aware of inflation — 61% think it will last for at least another half a year, with 99% of consumers saying inflation is going to have at least some impact on their spending. Over four in five consumers are acting cautiously with their cash.

In the context of this tightening disposable income, this is what UK consumers said about their spending habits over the next few months:

56% are going to buy fewer items or shop less

54% are going to buy less expensive things

41% will focus on shopping during sales

20% will buy from discount retailers

Only 7% say they don’t have any plans to alter their spending.

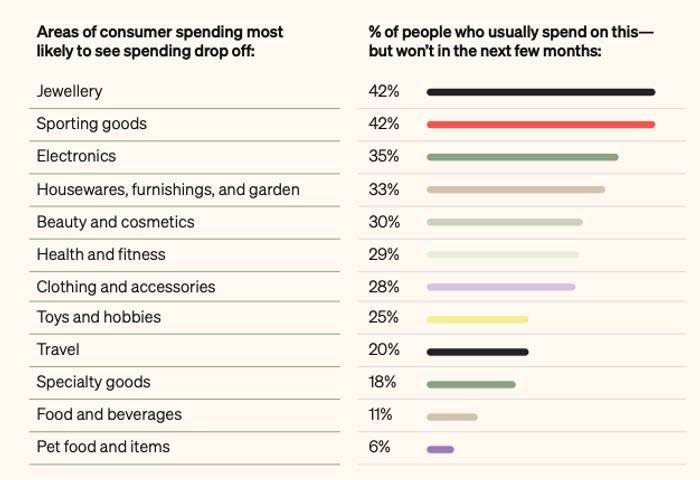

So, consumers in Britain are as price conscious as ever. Which areas will be most affected by this?

Jewellery — 42% (of people who usually spend money on this aren’t planning to for in the next few months)

Sporting goods — 42%

Electronics — 35%

Homewares, furnishings and garden — 33%

Beauty and cosmetics — 30%

Health and fitness — 29%

Clothes and accessories — 28%

On the other hand, those areas reportedly most shielded from consumer cost cutting are pet food (only 6% of usual spenders are planning to cut), food and beverages (11%) and travel (20%).

“Only 6% of UK consumers who spend money on pet food and pet-related products plan to cut their spending.”

What about demographics? Not everyone is equally affected. According to YouGov, those aged 55+ are the hardest hit, with 56% seeing a negative impact on their disposable income in the last 12 months; 18–24s saw the smallest net decrease at 39%.

There’s also a gender divide: globally, 47% of men saw a net decrease in disposable income compared to 52% of women. The same disparity applies to expectations of the future: 43% of men predict their incomes to shrink compared to 46% of women.

Unsurprisingly, those in lower and middle incomes are expected to feel the squeeze most — 54% and 50% respectively — compared to 42% of higher income households.

So, now we understand the UK consumer and their spending priorities during a squeeze, what are the things, brands and businesses they will still part with their hard earned for, even in a recession?

The industries, sectors & brands that ‘win’ during a recession or economic downturn

Whilst essentials like food, drink and fuel are well shielded during downturns, discount retailers stand to be the beneficiaries of tightening consumer pursestrings. Perhaps more interestingly, research shows that we also don’t compromise on spending on our pets and still prioritise travel and tourism.

The essentials — but discount retailers reign supreme

Naturally there are some items that even during a downturn we will have to continue to prioritise. These generally include the must-haves and things we cannot live (literally or comfortably) without such as food, drink, cleaning, clothing, fuel, energy, utilities and healthcare.

Cleaning and sanitation products are another well-shielded area, with Brits not allowing their spending cuts to impact the cleanliness of their homes. As any frequenters of #CleanTok will tell you, it’s sure to survive a recession. A global pandemic certainly hasn’t hurt the survivability of this sector, either.

That said, savvy consumers are constantly seeking ways to reduce the spend, swapping brands, supermarkets and driving less to ensure those overheads remain manageable. According to the ONS, more than four in 10 adults (44%) reported spending less on food shopping and essentials in the face of the cost of living crisis.

Discount retailers like Lidl, Aldi, Poundland, The Range and Primark are all time-honoured examples of recession-busting brands. They’ve seen a tidy uptick in sales, helping to contribute to a 1.2% growth in retail spending.

So, although there may be reductions, with a strong brand message, retailers can continue to compete and through support of their customers’ challenges, they can be seen ‘to help’. Prioritise empathetic messaging with a focus on discount ranges or savings to be had.

Then there’s loyalty schemes, points that can be redeemed, or even ‘buy now, pay later’ options. Controversially, this is now even available on Deliveroo, so price-conscious customers can split the cost of their takeaway into three!

Baby and pet products — only the best will do for Fido

That’s right. Be they human or of the fur variety, it seems we will always try to get the best we can for our babies. Again, some of these items fall into the essentials, but research has shown that some pet owners would rather go without food they love to ensure their pets get what they need.

As we highlighted earlier, UK consumer behaviour research reveals that only 6% of people who currently spend money on pet products are planning to cut back their spending in this area in the foreseeable future. Demand for products like pet food, baby formula, cat litter, toys, nappies and veterinary services is almost immune to economic turbulence, and we still prioritise quality.

So, whilst we’ll comfortably cut back on spending on ourselves, when it comes to our wee bairns or four-legged friends, we draw the line.

These brands also have a consistent opportunity to meet these needs and cement the equity of their brand in the eyes of their consumers.

Travel — not all is lost for tourism brands

Even under the pressure of other rising costs, our wanderlust is unwavering. With 88% of consumers say they’ve started planning a holiday in the next 12 months, we are still committed to travel.

Only 20% of those who currently spend money on tourism plan to reduce their spending — and we’d wager a decent volume of those people still plan to spend some money, just perhaps not as much.

This shows us that not only has anxiety surrounding the pandemic waned, but that our ‘seize the day’ attitudes have also remained. Consumers may have cut back elsewhere to satiate their thirst for adventure; this is a priority area that’s clearly high up the list of must-haves.

Of course, this comes more with the caveat of ‘those that can, do’. Having spare cash to spend on your jollies is clearly not the reality for lots of people with pressure on household budgets.

OK, so we know what is definitely still in, but what’s out?

The biggest ‘losers’ during an economic downturn

Research reveals that UK customers shy away from spending on jewellery, sporting goods, electronics, homewares and beauty products when the going gets tough. Our taste for a takeaway or a meal out also appears to take a particular hit during downturns.

In the wake of the current cost of living crisis, 64% are eating out less than usual according to a BBC survey, with 58% turning their nose up to takeaways at some point at least. In total, 23% less takeaway food was ordered this year - potentially a sign that we’re ready to curb the spending on treat food in lieu of those joyful experiences like travel.

BBC research confirms that consumers are reigning in their spending on big-ticket purchases like technology and home furniture.

Interestingly, despite the reluctance to frequent hospitality establishments as much as usual, alcohol sales from supermarkets prove surprisingly resilient during downturns, with these products falling into the category of ‘affordable luxury’. So, booze brands, not to worry.

What does this mean if your business or brand isn’t one of the lucky few recession-proof sectors? Should you be dropping your marketing to save pennies and wait it out? The answer is a resounding no.

How can my brand succeed during an economic downturn?

Even though consumers admit to making cost savings, they’re still spending money — with the right brand and product positioning and by offering some helpful incentives, you’re still in a great place to sell. No brand’s going to be dumped overnight, particularly those making an effort to understand their consumers and communicate the right message.

Provide a little incentive

You can’t get away from it: consumers are price sensitive. 54% are receptive to sales and discounts; there’s no arguing with the power of a good old voucher code or offer.

Discounts, free shipping or easy returns can encourage consumers to add more to their order, providing a higher cart value. Featuring your lower-cost items is key.

You might want to tie in consumer relationship building with incentives by creating a loyalty programme: 51% of UK consumers are receptive to a loyalty programme, according to Klaviyo.

‘Buy now, pay later’ schemes are another way to help your audience out, but they can be controversial, so be aware that your brand bears some of the responsibility for offering it. Be clear about how it affects your audience financially and discourage overspending.

Show why your product is important

Of course, discounts might not always be possible, especially given tightening margins, so what else can be done?

Since 44% are prioritising the ‘need to haves’, hone your product messaging about why your products aren’t just a dispensable luxury. What makes them necessary items of desire?

Don’t forget that high quality is still second on the list of importance for UK consumers when they’re deciding on whether or not to buy a product (above free shipping and below price). Display product reviews prominently; consumers say they’re still very important in the decision-making process.

Humanise your brand and hone your message

We talked more about this in our blog post about marketing during a recession, but in difficult times, it's important to re-focus on what your brand can really offer, what your values are and keep building trust so when your consumers can, they do choose you.

What sort of messaging do consumers want to hear from their favourite brands? According to Klaviyo, the top marketing messages are those that are:

Reassuring: 47% want to be made to feel safe about the future.

Humorous: 34% want their brands to be funny.

Motivational: 33% want to feel inspired by their brands.

Inclusive: 32% want to feel seen.

Showing empathy to your consumers is key to resonating.

Progression during a recession is still possible

The right marketing strategy is often all that separates the so-called winners and losers. If you fall silent in these times, be sure that your competitors will fill that void and capitalise on that opportunity instead.

Whether you’re a downturn winner or loser, our team of digital marketing virtuosos are experts at getting engagement growing and keeping sales flowing in tough times.

Drop us a message using the button below or reach us through our our contact page.

Need a helping hand honing your recession-busting marketing strategy?

Get in touchPost by

Johnny bridges our content and SEO teams, creating and managing strategies that elevate clients' organic search visibility.

Project

Post by

Since forming Extreme’s social media department back in 2012, our Head of Social Donna and her team’s work has been recognised nationally. With extensive experience spanning mutiple sectors, Donna specialises in social strategy, ideation and paid social advertising.

Project